Is a Financial Tsunami Building up?

Just as the

stock price of Tesla kisses $2000 (and by the time i finish writing this piece, it might be $2200) and Apple is way past the 2Tr$ Marcap, I receive a text message from

an enthusiastic friend of mine who first started investing a few months ago

(March 2020) after being forced to work from home and shared his stellar

success at his new-go at the markets. He shared his desire to be a

professional fund manager and started exploring ways to get a SEBI license to

be a RIA (Investment Advisor) or a Portfolio Manager.

funds for family and friends all life and now as a professional Fund Manager

since the last few years, and having seen euphoria and fear again and again, I

can say with some degree of confidence that this time it isn’t different and something is about to give way.

Covid has

been the most unfathomable disruption, the likes of which hasn’t been seen by

anyone alive today. The concept of Black Swan stands redefined which – till now

– was an unexpected and improbable event and people would often relate to it by

comparing it with a Tsunami or an accident or a sudden unexpected failure of an

enterprise with global ramifications.

No one had ever imagined that within days, the global borders would be closed,

airlines across the planet would be grounded (95% still remain grounded as I

write this), and all levers of the global economy (travel, trade,

manufacturing, shipping) would come to a grinding halt. ‘Sudden Stop’ in global

economy was an academic expression that became a reality almost instantly.

Some 30 million Americans lost their

Some 30 million Americans lost their

jobs (more than 3

times than the previous highest), markets crashed by about 40% in 3-4 trading sessions, China got blamed for its alleged Chinese Virus, oil hit (-) 37 $

while the global leaders remained clueless and the only policy response was a

complete lockdown of nations as leaders grappled with the enormity of the situation.

Hundreds of

millions of people have lost their jobs and millions of small businesses

have shut down forever and the economic contraction has been so secular that

some of the most high flying businessmen and executives have resigned

themselves to the new normal only yearning for their basic needs to be met for

their families and themselves.

While some countries have shared the real data and the extent of severe and

unprecedented economic contraction, most have conveniently chosen not to release

the same either to avoid embarrassment or to avoid panic. But imagine, for a

second, that everything (revenue, earnings, profit, salaries, rentals, commoditiesetc etc etc) gets deflated by 40-70% – what effect

it is likely to have on the global economy.

If the

savings rate from income varies from 1% to 25% in different parts of the globe (it

is believed that more than 70% Americans have less than $500 in savings and the

max savings rate is about 25% in China and India), it is safe to assume that

every person on a monthly salary / entrepreneur is already digging into life

investments and assets to keep afloat as the inflow (after salary cuts or loss

of income) is far lesser than the outflow. Majority of my friends and

acquaintances have either stopped their SIPs or redeemed their Mutual Funds. I read that last 2 months have been

the worst for the MF industry because of incessant redemptions and negligible

inflows.

And Yet…

The Indian

and global stock markets have shown immense resilience making these an easy ATM

to churn out daily profits for Robinhooders.

Human memory

is short and 10 years is a long time to lose and gain confidence all over again

and the stars (Corporations and Executives) of yesteryears fade away while the

new ones emerge on the evolutionary principles of Creation – Preservation and

Destruction

It is

believed statistically that 95% of market participants and fund managers have

less than 12 years of experience which implies that only 5% have seen the crash

of 1987, 2000, 2008 and a few other mentionable flutters in between. And human

mind is generally tuned to be optimistic as hope and evolution trains the mind

to expect a better future always in every which way. Little credence is given

to people who invoke caution and sometimes border pessimism as a result of

lifelong experiences and perhaps that’s the reason the world is deriding WarrenBuffett for having lost a decade by underperforming and not investing in Tesla

and Amazon and all the 30 yr olds have seemingly outperformed by simply

investing in Tesla or Kodak or Overstock kind of shares.

Parameters

such as performance Ratios, Profits, Real cash in the hands of shareholders

have lost every mentionable significance and price earnings of 200/300 or even

1000 in case of Tesla seems like ‘THE’ new normal.

And while the bears have been irreparably scathed in this recent melt-up, it

would be prudent to remember that over long periods of time, either the price

catches up with the fundamentals of a stock or the fundamentals catch up with

the price, but just to put the things in

perspective (and I know nothing about Tesla and am not a Tesla basher sitting

here in India – but it’s a good example) if Tesla was to maintain its present

earnings, it would take about 1000 years to fully recover ones investment

through Tesla s present earnings. Anyone who buys a Tesla stock now is valuing it at

approx. a million dollars for every car sold.

Markets are

a beautiful place that allow immense wealth to be created and accumulated for

people who have patience and discipline but history is replete with examples of

more than 70% of investors of all times to have permanently lost capital by

chasing garbage (aka penny stocks) that seems to provide short term euphoria.

Lets talk of

a few Indian stocks and themes or should I say wealth destroyers.

Between 2003 and 2008 Infra and Housing was a great story and a mere

‘infratech’ (use of tech and infra) in a company s name would get it rerated.

Unitech, IVRCL, HCC, NCC, Sintex, DLF, …………… have destroyed almost 99% of

shareholder wealth and most of these names have got delisted leading to

permanent destruction of wealth. During hay days these were stocks that were

the market darlings

Then came

the era of banking and finance. Between 2009 and 2018 NBFC s and Banks had a

dream run before the euphoria and invincibility of the sector was popped by the

ILFS, Yes and DHFL type of fiascos and recently while a top outgoing CEO dumped

his entire shareholding and ESOPS of 26 years in a jiffy (perhaps to pay for

the expenses of grocery, maids and electricity bills during tough times amidst the

pandemic), the gullible public and minority shareholders will be the last to

keep holding the hot potatoes and the music would stop suddenly.

And Now

We have the

API and the pharma theme on an assumption that all the medicine factories on

this planet will stop production and all pharma orders will come rushing to

Indian companies and the world population might start eating medicines instead

of fruits and vegetables all produced by Indian pharma companies.

The same

story gets repeated again and again. While the robinhooders are gloating in the

wealth created by some new age, recently discovered pharma companies doubling

in the value in less then 2-3 months, the end is always painful when the music or

the party stops. And by the way graphite was the pharma of today or pharma/API was the graphite of those times.

The 5%

people who have been around, all of them understand this, having gone thru

cycles, but the 95% neither have the wherewithal or the research to truly

fathom the depth or the lack of it in the present euphoria.

Every crop

must be harvested at a specific and optimum time, lest it should rot. Same goes

for ones stocks, corporations, businesses. Buying or creating is natural to

ones instinct of evolution, letting go / harvesting is an art which very few

understand or develop. And most end up in a feeling of regret esp small and

minority retail investors who fall in love with their stocks, cannot sell and take the profits home.

The trouble

is that most fund managers are obliged to be eternally optimistic (ignoring the

risks) else they would face redemption thereby leading to lesser fees for the

fund-house. Very few investors realize that cash in itself is a strategy and a

position worth considering and to be in from time to time.

As Howard

Marks says “To be a disciplined investor you have to be willing to stand by and

watch other people make money on things that you passed on”.

Irony of the

markets is well evidenced, rather strongly in just this one case in point :-

PVR Cinemas

PVR used to

be a perfectly fine and a successful popcorn and coke reseller till the

pandemic struck and just 11 days of disruption in March saw its profit fall

thru the floor. The future is bleak with zero sale in first 2 quarters and any

of the movie buffs whom I have spoken to in Delhi, Bangalore and Bombay (where PVR has max

screens) are not going back to a cinema hall as people have found a new freedom

on OTT platforms and using affordable projectors at home and replicating a

cinema hall effect without risking oneself to the virus-exposure.

Producers are

preferring – selling to and releasing movies through OTT platforms as that

reduces their risk to zero. And yet retail investors are finding virtue in this

company that has zero sales, bleak future, debt ridden and trading at 300 times

its trailing earnings and no visibility of the future earnings. Some PVR stock

lovers say – all will be well in a few years, we are looking at 2030.

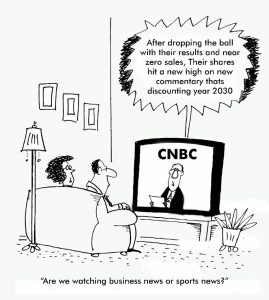

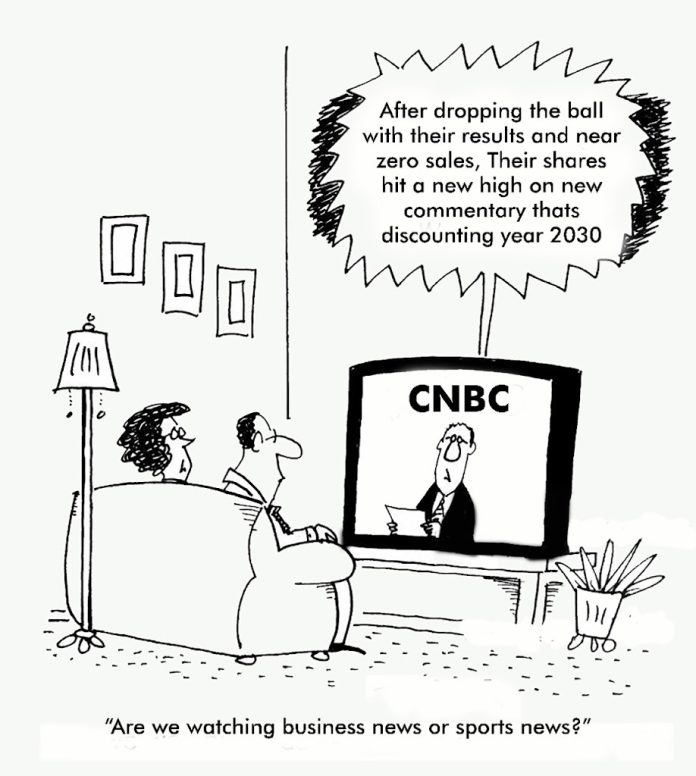

CNBC has

single headedly taken it upon itself to create a euphoric environment shrouded

by global liquidity and has allowed all dubious promoters to talk up their

stocks only on the base of ‘positive commentary’ as if the alchemist in them can

turn just commentary into profits, cash and dividends.

On the other

had a company like ITC that produces more cash and profits than all the other

6-7 top FMCG companies, is debt free, is trading at abysmally low valuations

(15 times trailing earnings) and yet the robinhooders find it less appealing.

This

dichotomy will self correct sooner rather than later and will come with its own

collateral damage which most new entrants in the markets aren’t ready to handle.

Harvest Your

crop, take profits off the table, let some notional profits be lost along the

way but evaluate the risk and reward that any company, valuation, story,

potential – offers.

If this fine art of valuation equilibrium can be

discovered, small investors would do themselves a great service of increasing

their longevity in the markets and protecting their capital.

Enjoy the party, stay close to the door, so when

the stampede starts, You can safely escape without being trampled.

My twitter handle @manurishiguptha

www.manurishiguptha.com

As always, great article Manu – Would you recommend moving out of stocks at this time?

Well said 👌. As of now, no takers for this view. I am in your group of thinking. Let's hope this time it's different.

Aptly worded .

crucial period to cross through.

With the current liquidity boost by all major central banks, the concepts of P/E, RoCE, RoE need to be reevaluated.

If my cost of capital is, say 1%, then I would not mind paying for high P/E or low RoE stocks.

Hence, I believe that the old formula of P/E less than 20 is good and above 30 is expensive may need to be recalibrated. Going forward, as long as easy money remains, 30 may become the new 20.

Not able to understand the concept of harvest and take the profit out of the table..this is okay incase of short term trading stocks…I have position in ITC, Altria and BAT….all are extremely undervalued and have bought for lifetime as of now…are you recommending to sell after a normal profit in these stocks or hold till the business changes its fundamentals…pls

What are you exactly suggesting? Should we sell all our portfolio holdings and wait for the right time to re-enter?

But the same wisdom a few days ago could have worked in recently concluded AGM. Now AGM is at least 11 months away and by that time every body including rishi Gupta will forget.

Well articulated.

With a severe 2nd wave sweeping all across Europe, the global economy may have more shocks in the near future.

And market movements tend to be exaggerated in either direction these days